IRS PTIN Renewal 2017

Hey all, it’s that time of year again for the IRS PTIN Renewal 2017. Each year the IRS requires preparers of federal tax forms to renew their PTIN. You can check out our step by step PTIN Update Instructions here for a refresher of what the process looks like, but there seem to be a few changes this year.

Update IRS PTIN Account Email

First, the IRS sent out an email where they REPEATEDLY stated, you can change your email address if you want. It does not matter if you use your personal email or work email, just so long as you check it for PTIN related news.

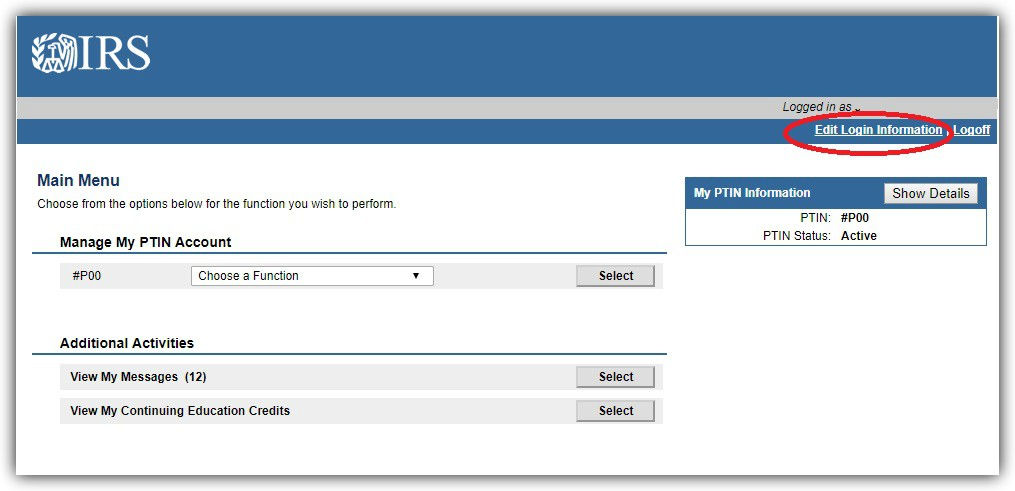

To change your email, just login, and click the button to “Edit Login Information” on the top right. It looks like this, and it’s pretty self explanatory from there.

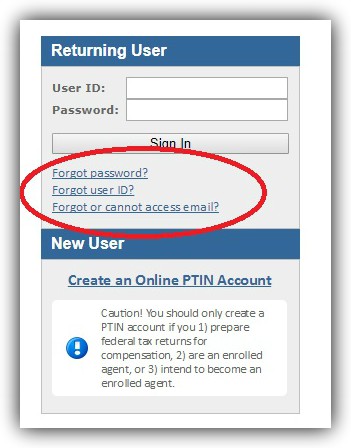

If you can’t login, don’t forget the IRS puts all the helpful tools right on the login screen. You can access your login information by clicking the “forgot user ID” link or the “forgot your password” link. The emails can take 20+ minutes each to arrive, but it’s actually a pretty easy process and considering the penalties and interest it can SAVE you from, it seems pretty worth it to me!!

2017 PTIN Renewal is Free?

Second, there may be some changes to the fee this year. As in, there may not be a fee this year.

Click the link found below for details straight from the horse’s mouth.

IRS statement and FAQs here: https://www.irs.gov/tax-professionals/irs-reopening-preparer-tax-identification-number-ptin-system

IRS PTIN Lawsuit

The class action lawsuit filed against the IRS, stated IRS could not charge for a PTIN number. The courts upheld the IRS’s authority to insist on a PTIN for all tax preparers, however it was decided IRS could not charge for the PTIN.

The IRS PTIN renewal 2017 could possibly be free this year, but even if it’s not, you will need to renew your PTIN to keep filing Form 2290 or any other Federal tax form in 2018.

The class action website here: www.ptinclassaction.com

Need any more help? Call us at 844-343-3453.

Recent Comments